Sameer Africa founder Nashaud Merali has worked himself into one of the wealthiest persons in the country through both sheer hard work and wits.

The billionaire is revered for his savvy business dealings, and the fact that he made Ksh1.6 billion (then $20 million) in one hour is testament enough for his shrewdness.

By the year 2000, the businessman had a 40 percent stake in telecommunications company Kencell (now Airtel). The remainder was owned by French Firm Vivendi.

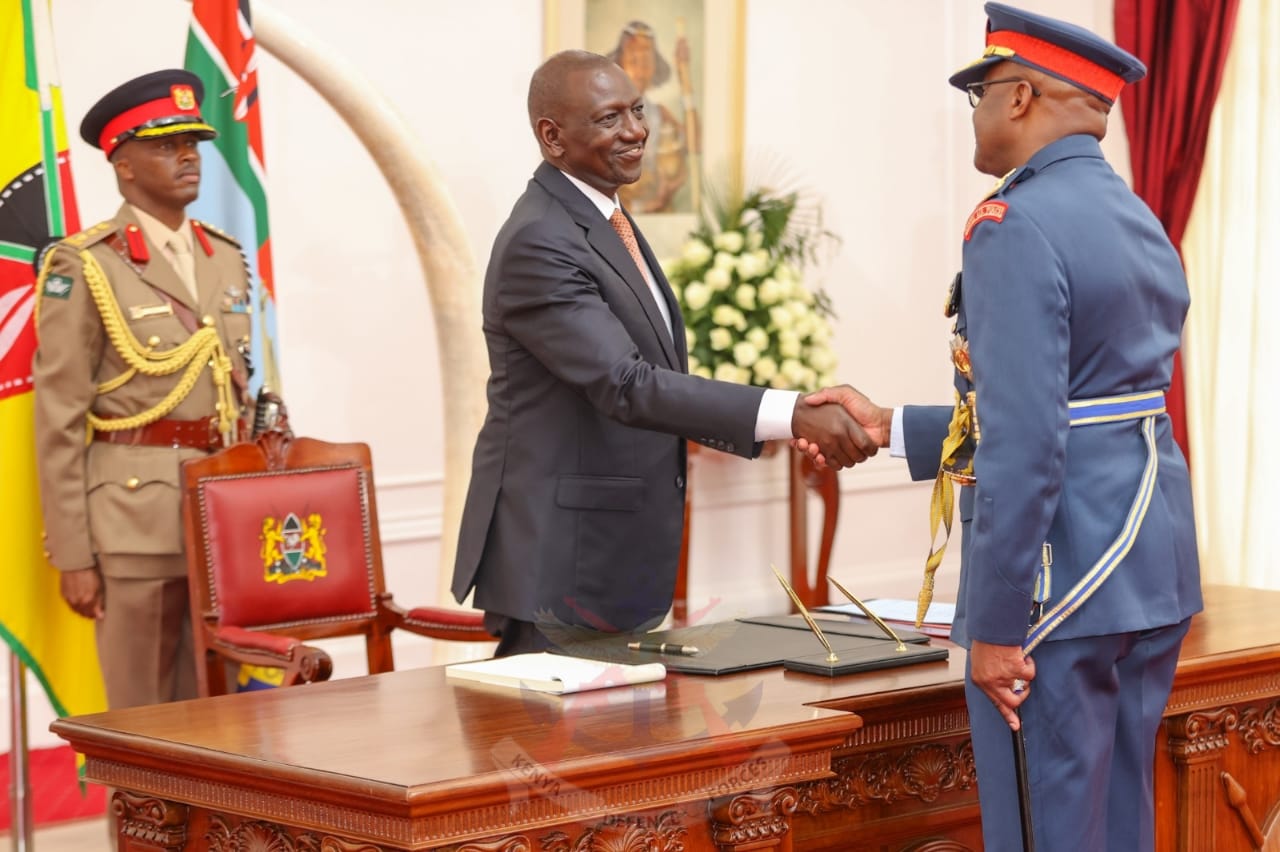

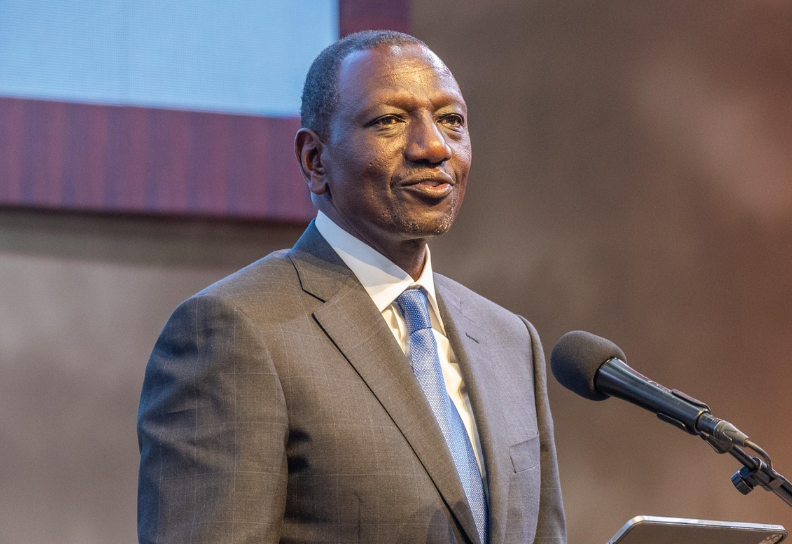

File image of Sameer Africa Group founder Nashaud Merali. |Photo| Courtesy|

Read More

In 2004 the French company wanted out, creating a leeway for Merali to orchestrate one of the greatest deals in Kenya's corporate history.

Using his pre-emptual rights as a shareholder, Merali convinced Vivendi to sell him their 60 percent stake in Kencell.

Negotiations of the buyout were conducted in Merali's office at Sameer Africa headquarters which were located at Riverside Drive, Nairobi.

As the negotiations continued between Merali and Vivendi, billionaire Mo Ibrahim owner of Celtel Kenya, which wanted to buy into Kencell was waiting in the next room.

Meralli managed to convince Vivendi into selling him their share for $230 million. He walked into the next room an hour later and sold it to Celtel for $250 million.

In 2008, Merali sold half of his 40% stake to Zain and later reduced it to 5%, selling his 15% stake in 2009.

In 2010, Zain wound up operations in Africa selling its interests to India's Bharti Airtel.

Merali became the owner of the Kenya Data Networks through his investment vehicle Sameer ICT, which in 2008 owned 96% of the firm.

Merali is also the chairman of Sasini Limited.

Forbes Magazine in 2014 listed Merali as one of the wealthiest men on the continent with a net worth upwards of $550 million.

-1702720543.jpg)

-1713447672.jpg)