NCBA Banks has confirmed that they are willing to pay Sh350 million waiver they were accorded during the merger of NIC and CBA bank back in 2016.

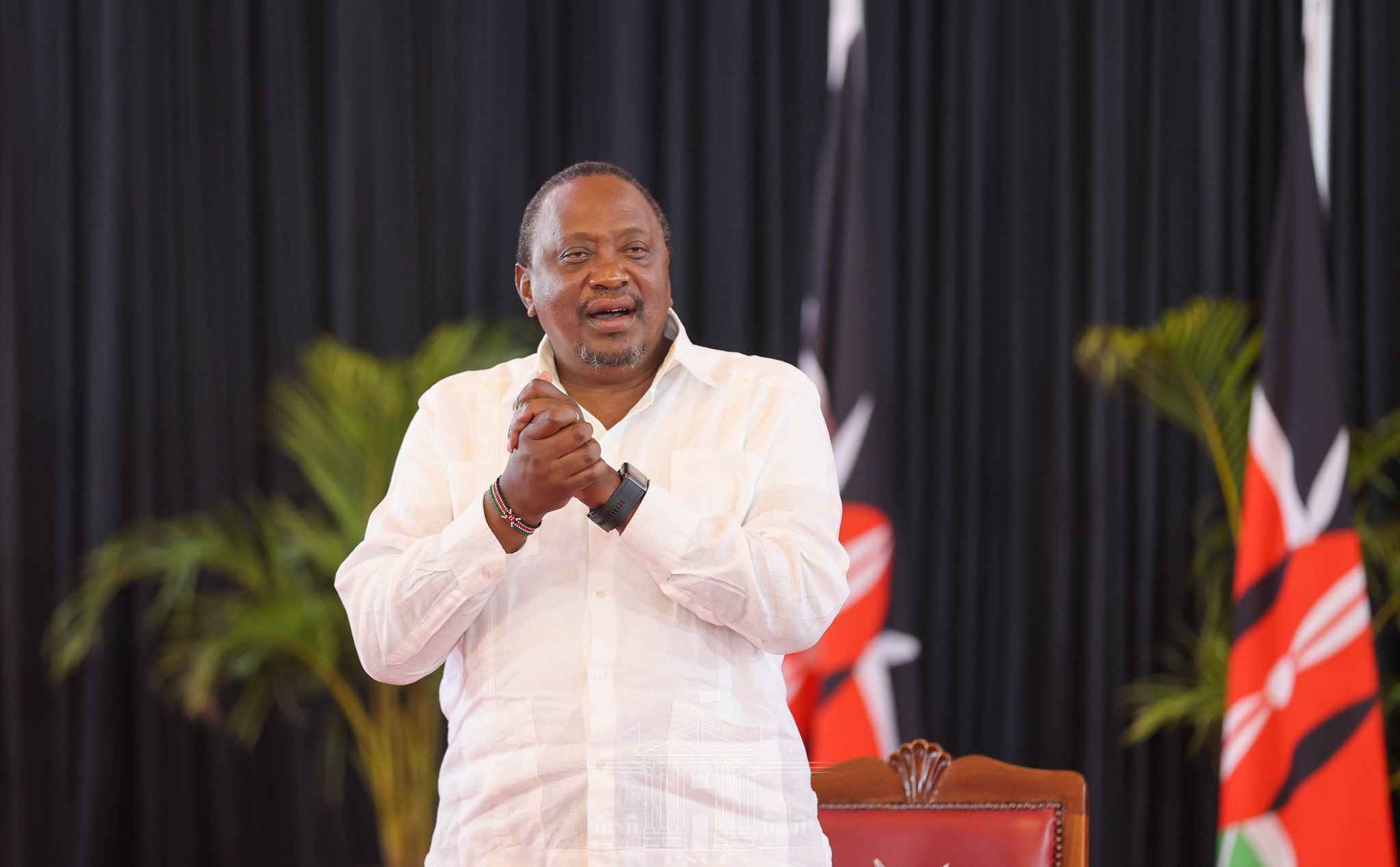

This comes in the wake of sustained onslaughts by President William Ruto, his deputy Rigathi Gachagua and their allies against Former President Uhuru Kenyatta’s family.

The family in the last few weeks has been on the receiving end of criticism with Ruto allies claiming that they could have been tax cheats during Uhuru's regime.

In a rejoinder to the onslaught, NCBA Managing Director John Gachora has disclosed that they have no problem paying the waiver back to the state as long as the due process of the law is followed.

Read More

He noted that what happened during the waiver is a common legal practice.

"Should the court find that NCBA was not entitled to the waiver, I want to assure Kenyans that we will write a cheque to KRA the following day. That one we are ready" the MD.

Gachora said that despite the waiver being accorded to them during the merger, they still managed to pay a tax of Sh4.4 billion in that year.

He said the business has been operating within the law and it will abide by it when carrying out its operations.

"We are one of the biggest taxpayers in the country. We paid Sh6.7 billion in 2021 and we will pay a whooping Sh14.3 billion tax for the year 2022," he said.

-1713447672.jpg)

-1713536678.jpg)

-1710390248.jpg)