President William Ruto's administration is at an advanced stage of establishing a new company to give credit to small-scale traders in the country.

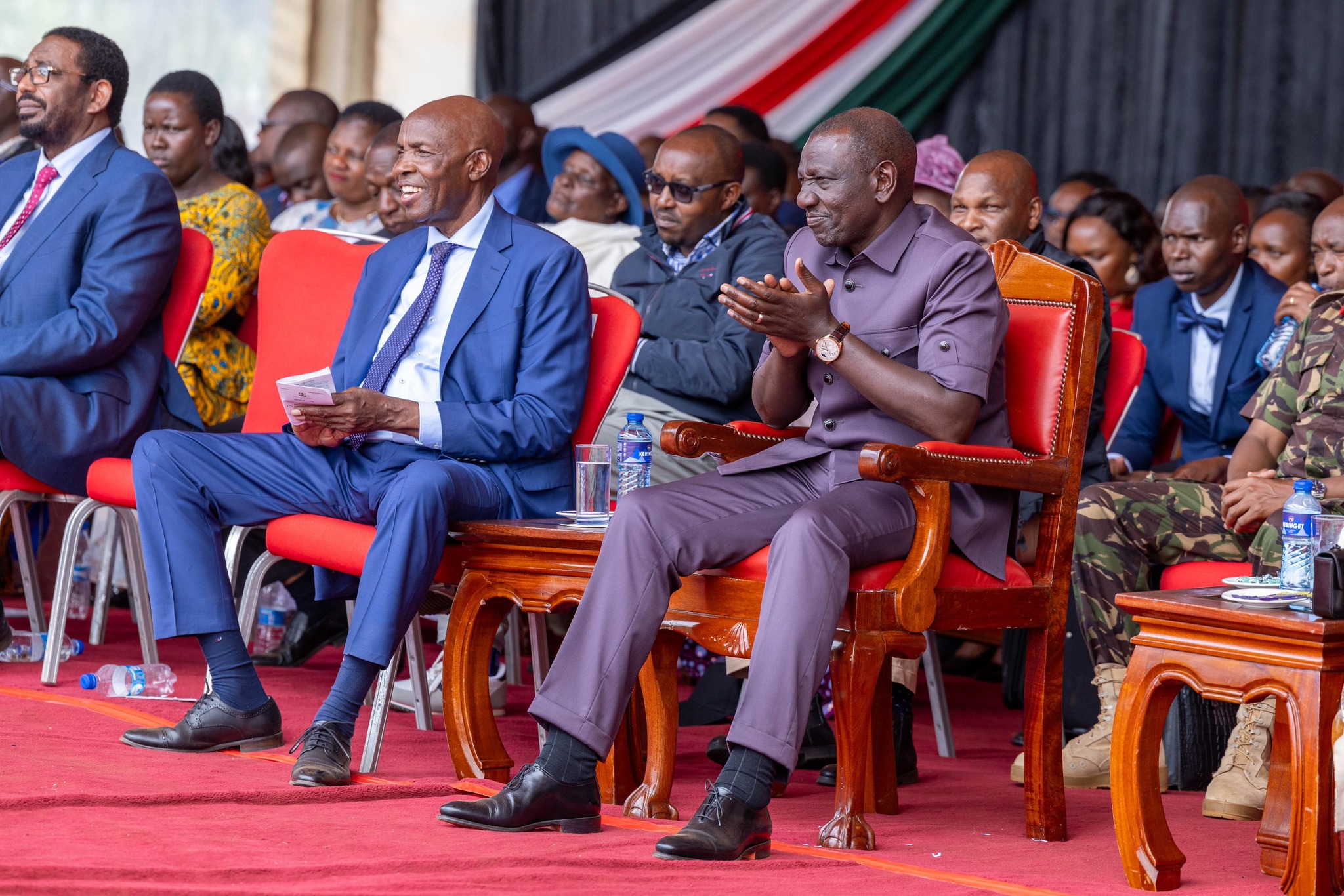

The plans for the establishment of the new company were revealed on Monday, March 11 during a meeting between Treasury Cabinet Secretary Njuguna Ndung'u and his Cooperatives counterpart Simon Chelugui.

The two revealed that the new entity will be known as Kenya Credit Guarantee Company.

"The Company aims to boost credit access for MSMEs, crucial as the MSME sector contributes about 34 per cent of GDP and empowers about 15 million people," Treasury announced.

Read More

Once operational, the Kenya Credit Guarantee Company will provide credit guarantees, mitigating risk for lenders and encouraging SME lending.

The National Treasury insisted that the company will be vital for the majority of businesses in Kenya.

"The Financing gap for MSMEs is staggering, with banks only lending 783 billion out of a trillion," the National Treasury indicated.

Already, a taskforce has been forced to expedite the formation of the Kenya Credit Guarantee Company. The launch date and location will be published once a final report is presented by the taskforce.

The new company will supplement Hustler Fund which was launched by President William Ruto to support small-scale traders and saccos in the country.

The fund has disbursed Ksh39.7 billion to 21.8 million people and mobilised Ksh2 billion in savings. Total repayments stand at Ksh28.75 billion.

“Additionally, for those who have demonstrated a commitment to saving, and your savings exceed your loan limit, we will double your credit limit,” Ruto announced in November 2023.