President Uhuru Kenyatta has hailed the Kenya Revenue Authority (KRA) for unveiling a new website (https://iwhistle.kra.go.ke) where Kenyans can report tax cheats.

On the website, Kenyans can report several tax offenses including; failure to pay taxes, tax fraud, providing wrong data while filing annual returns among others.

In a bid to encourage more Kenyans to report tax cheats, KRA has put together an incentive for persons who file reports on the website.

According to KRA, the reward is dependent on the collection of revenue on tax fraud/Tax evasion schemes. The reward includes whichever is less of, 5% of the taxes or duties so recovered or Sh2 million per case.

Read More

While the platform guarantees anonymity, anyone seeking to be rewarded must forego their anonymity and will be required to provide their bank and personal details.

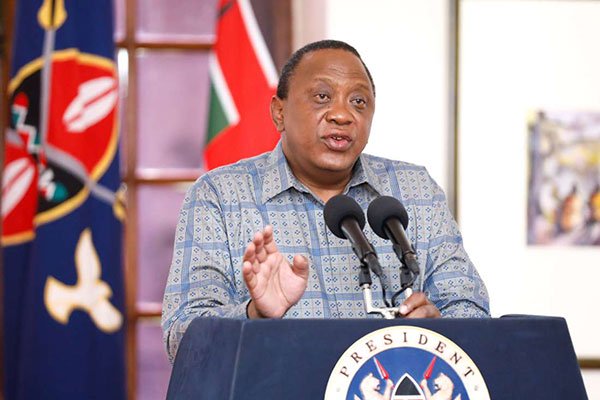

Uhuru’s Directive on Rewarding Kenyans who report tax cheats

Speaking during the Kenya Revenue Authority Virtual Taxpayers' Day, President Kenyatta directed the tax body to increase the reward to an amount between two and 5 million shillings.

According to the president, having a handsome reward will motivate more Kenyans to report tax cheats.

“The web base system will ensure that incidences of tax evasion or unethical conduct by some KRA staff, are recorded and confidentially investigated and acted upon. I direct the informer award scheme be amended to increase the reward amount from Sh2 to Sh5 million,” he said.

When reporting a tax cheat, one needs to provide; Financial Records (Profit and Loss, Audited accounts), bank statements, bank details, Paybill details, till numbers, pin number, location of the business or offender, and mobile contacts of the violator.

According to KRA, an investigation takes 60 working days for completion timelines. However, investigation/auditing for collection of taxes can go beyond the above to a maximum of two years depending on the nature of the case.

-1713447672.jpg)