KCB Group PLC posted KShs. 30.7 billion in net profit for the nine months ending 30th September 2023, as its assets grew to KShs. 2.1 trillion.

Profitability increased from KShs. 30.5 billion reported in a similar period last year while the balance sheet expanded by 64.5% from KShs.1.28 trillion on the back of consolidation of DRC-based subsidiary Trust Merchant Bank (TMB) acquired in December 2022 and organic growth.

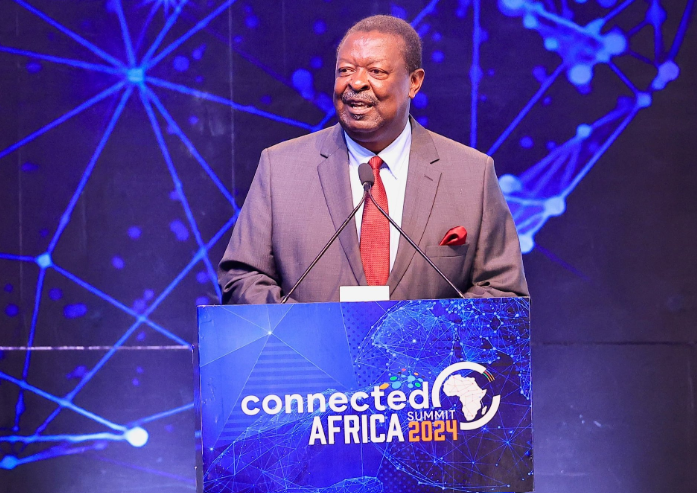

Speaking during the release of the Q3 financial results on Wednesday, November 22, KCB Group CEO Paul Russo noted that they've had a difficult nine months due to a tough operating environment that has negatively affected customers.

"Our performance was borne out of diligent implementation of our strategy, which saw us close the 16% gap in PBT from Quarter 2 performance. Our focus has been on a speedy and sustainable resolution of our customers’ pain points and ringfencing the business to guarantee long-term growth," Mr. Russo stated.

(2).jpg)

Read More

The contribution of Group businesses (excluding KCB Bank Kenya) to the overall profitability was up to 27.9% from 16.4%.

Profit before tax from the Group businesses stood at KShs. 11.3 billion from KShs 7.1 billion in the previous year. The contribution to total assets improved to close the period at 32.2%.

Non-funded income increased by 38.7% from KShs. 30.6 to KShs. 42.4 billion on enhanced investments in digital capabilities while funded income was up 21.6% to KShs. 74.9 billion from KShs. 61.6 billion on loans.

Total Costs closed at KShs. 60.8 billion during the period, mainly contributed by legacy legal claims at NBK, staff restructuring expenses and TMB consolidation.

-1700718169.jpg)

-1710390248.jpg)

-1670665275.jpg)

-1714135201.jpg)