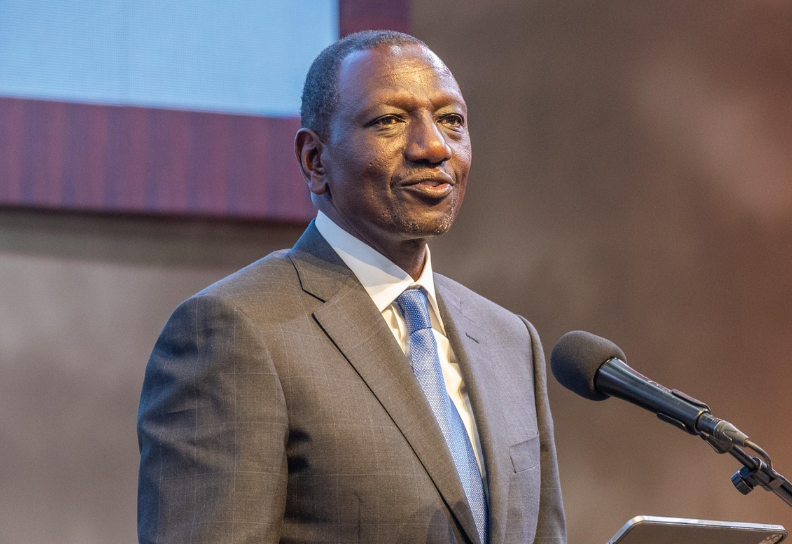

Embattled director general of the Communications Authority of Kenya (CA) Ezra Chiloba is now on the radar of the Ethics and Anti-Corruption Commission (EACC).

The anti-graft body is probing allegations of abuse of office and conflict of interest in the name of Chiloba all allegedly perpetrated between the 2021/22 and 2023/24 fiscal years.

In a communique addressed to Chiloba on Friday, September 29, the EACC demanded a host of documents from him to facilitate the ongoing investigations.

Among the deeds required of him are the mortgage loan budget for the financial year 2021/2022 to 2023/2024, bank account statements for the Mortgage Scheme for the period 2021/2022 to 2023/2024, an internal audit report, the National Treasury audit report and the mortgage loan policy for CAK.

Others are the mortgage loan book for CAK, authorized panel of valuers at CAK, minutes of the Special Board Audit and Risk Assurance Committee dated August 8, 2023, and Chiloba's mortgage loan application form.

Read More

Chiloba was suspended from his plum post on September 18, and Christopher Mutua was appointed to take over on an interim basis.

"Following a meeting of the Authority’s Board held on 18th September 2023, resulting in the suspension of the Director General, I am pleased to inform all staff of the appointment of Mr Christopher Wambua as a Director General in Acting Capacity effective today until further notice. I trust that you will accord him the necessary support," read a memo from Mary Mungai, the CAK board chair.

At the centre of the saga was a supposed misuse of the Sh662.4 million CA Staff mortgage scheme.

Special Board Audit and Risk Committee (BARAC) report considered by the CA board established that there were defaults to the tune of Sh28.9 million for mortgages approved and granted without consideration of the contract term of employees.

The report further brought to the fore a Refinancing mortgages to the tune of Sh364.8 million for staff who lack evidence of the upgrades and/or improvements for their purchased and/or construction houses

The board also learnt of Material Variance of more than 20% in Property Valuation between the government and privately contracted valuers.

The findings also revealed that there was an understatement of loan balances for former staff of the Authority

The audit also established inadequate approvals of Architectural Plans/Designs for Construction Mortgage Facility therefore exposing the authority to abuse of the facility and financial risk.

It was also noted that there was a failure to undertake a timely Mortgage Insurance Protection Advance for the property.

The audit on the CA Staff Mortgage scheme was carried out on May 3, 2023, and a report was presented to the board on August 8, 2023.

-1714640381.jpg)