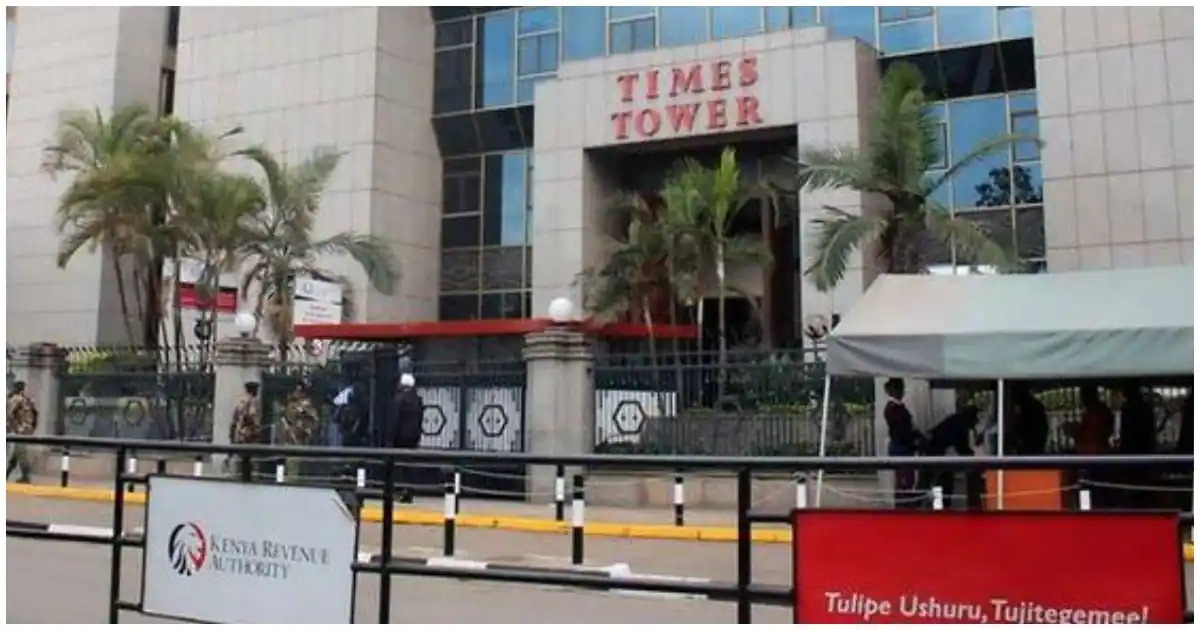

The Kenya Revenue Authority (KRA) has issued a two-month ultimatum to Kenyans with unpaid principal taxes.

In a statement on Thursday, April 25, KRA urged taxpayers to take advantage of the ongoing Tax Amnesty Programme to regularize their tax compliance status.

“The Authority urges Kenyans who have not been filing their returns to do so before 30th June 2024 and those that have not been paying and have accrued penalties and interest on their unpaid principal taxes to take advantage of the amnesty and clear any outstanding principal tax debts by 30th June 2024,” read the statement in part.

KRA noted that there will be no amnesty, waiver, or write-offs on penalties and interests after the ultimatum lapses on June 30, 2024.

The Authority pointed out that the Tax Amnesty programme does not apply to customs and import duties and interest and penalties accrued after December 30, 2022.

Read More

At the same time, KRA announced that it has collected overdue principal taxes amounting to Ksh 20.8 billion, with a total of Ksh 28.7 billion having been self-declared as unpaid taxes.

“Taxpayers who had defaulted on filing and paying their taxes have so far benefited from Ksh 244.7 billion in waiver of penalties and interests. KRA encourages more taxpayers to take advantage of the programme,” KRA added.

The Tax Amnesty Programme was introduced in the Finance Act, 2023 to allow taxpayers to benefit from amnesty on penalties and interest accrued for periods up to 31st December 2022, upon full payment of their respective principal taxes by 30th June 2024.

The programme aims to enhance compliance and revenue mobilization, while giving taxpayers with tax disputes a leeway to benefit from the existing Alternative Tax Dispute Resolution framework.