The Higher Education Loans Board (HELB) has announced plans to cut off student loans to 95,000 beneficiaries.

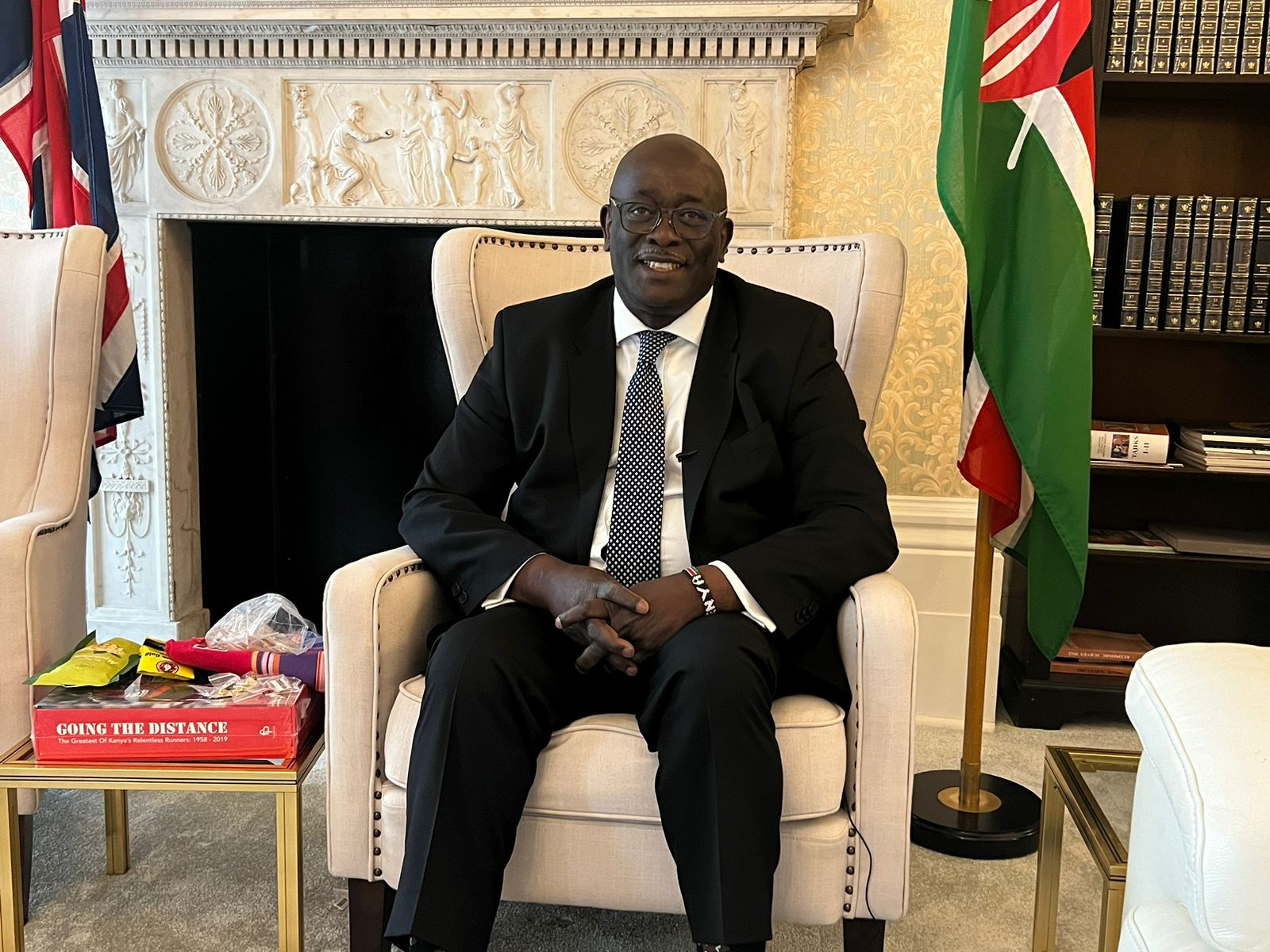

HELB CEO Charles Ringera said that the economic turmoil brought about by the Covid- 19 pandemic has drained revenue from the government forcing it to revise the number of students it can help in the scheme.

"We are worried how we are going to manage the situation. But that is the way it is. There are no revenues flowing into the country. People are unemployed. So they cannot repay their loans.

"So we will have to deal with what we have," Ringera stated.

HELB had iniatilly lined up 545,000 students who were to benefit from the Ksh15.5 billion loans.

Read More

The number comprised of 110,000 students from technical training institutions and 340,000 from universities.

"The board set to lend to 110,000 students in technical colleges but only 80,000 will benefit. Cuts in beneficiaries are unfortunate because no one asks for a loan if they do not need it," Ringera said.

This comes two months after university students across the country decried tough survival conditions, and the inability to foot their school fees.

At the time, Ringera noted that HELB had no money due to low revenue collections, and the National Treasury was yet to disburse the funds.

“Things are not good. We are waiting for funding from the Exchequer and our collections are not quite good because of the Covid-19 situation. The students will have to be patient and bear with the situation,” said Ringera.

Embakasi MP Babu Owino threateed a nationwide strike, after which he held a meeting with CS Ukur Yatani and was assured the funds will be released.

“I have just met CS Treasury who has assured me that students’ money HELB will be disbursed tomorrow without fail (2.83 Billion shillings) But even should it fail then we still have other lethal options of getting the money,” Babu had tweeted.

Following Ringera's revelations, thousands of students are set to miss out on the loans, despite prior assurances of availability of the funds.

-1680703413.jpeg)